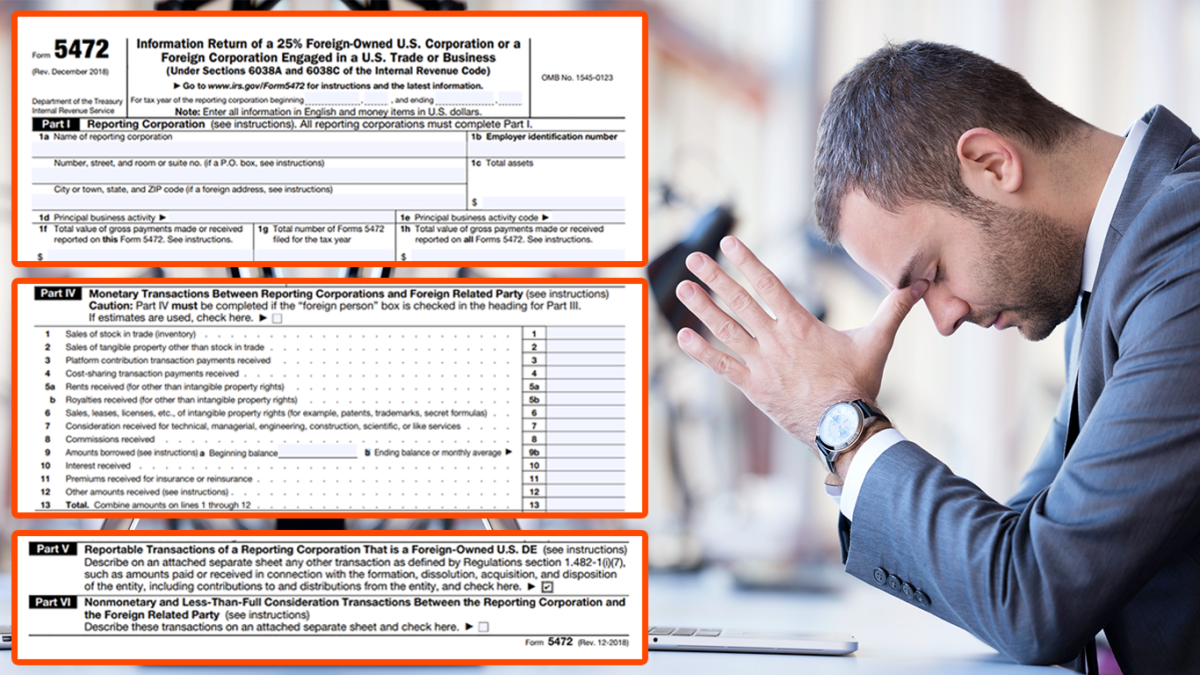

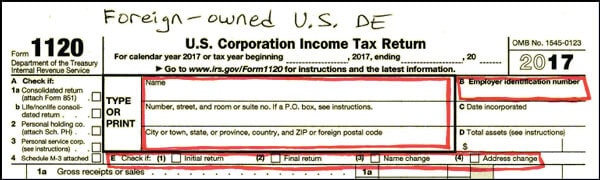

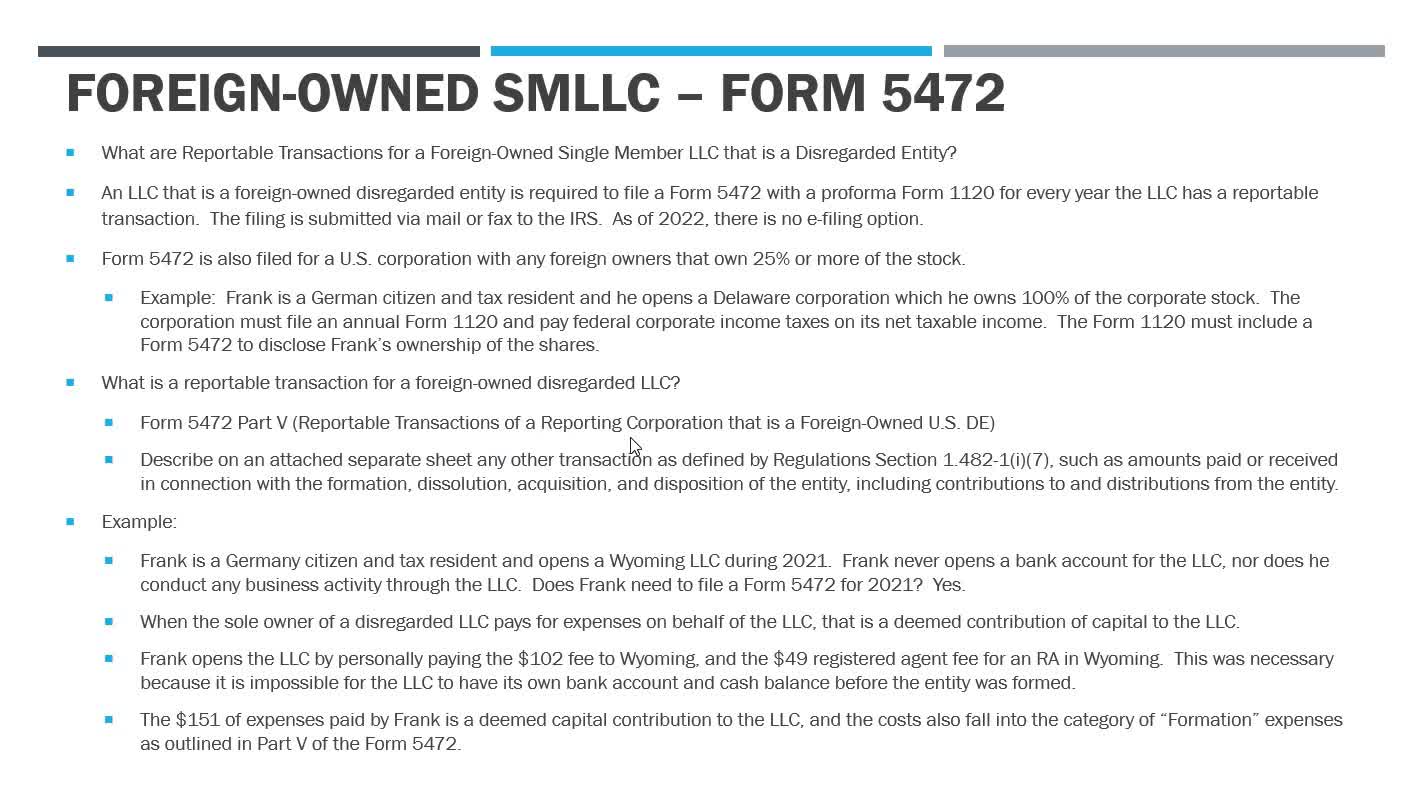

What's New: Foreign-owned single-member LLCs now must file Form 5472 | Alpha Opportunities International, Inc.

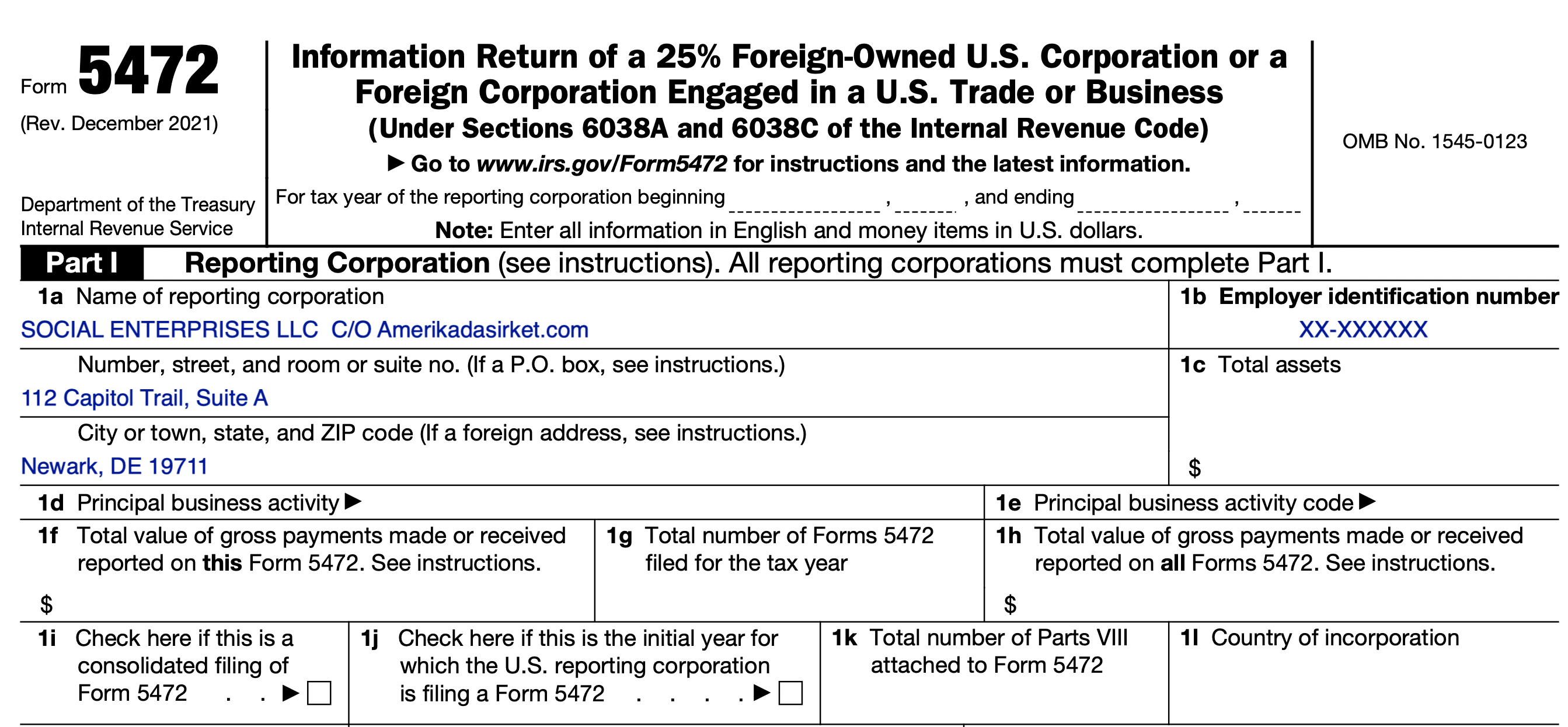

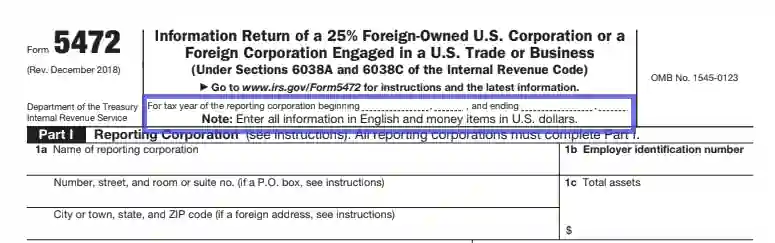

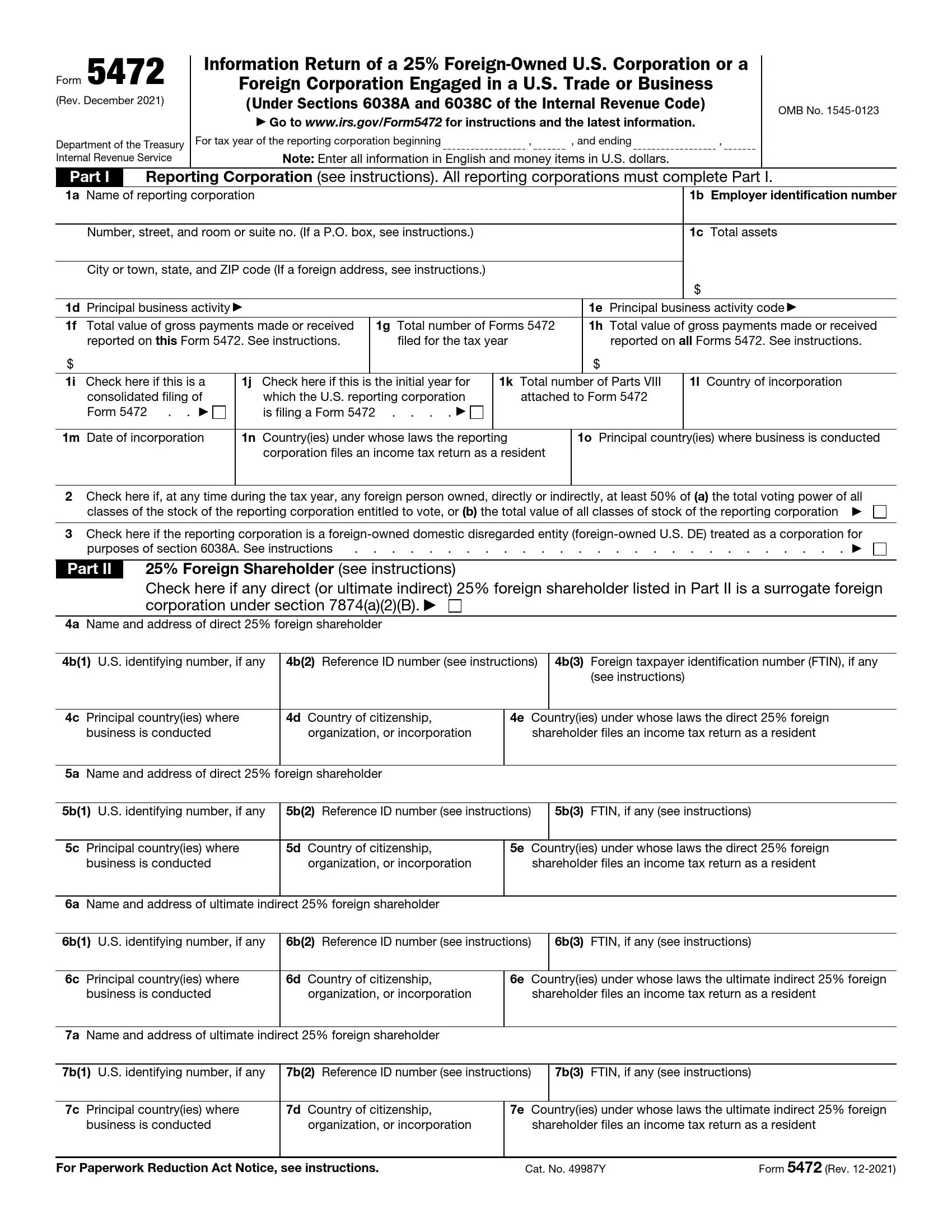

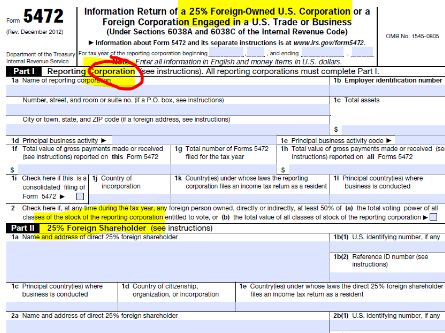

Form 5472 -Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business - HTJ Tax